You are here

Staff Fringe Benefits

Quick Links

- Budget & Cost Resources

- Cost Accounting Standards

- Direct and Indirect Costs

- Indirect Cost Rates

- Full Recovery of Indirect Costs - Calculating space for certain private sponsors

- Direct Costs

- Salaries

- Staff Fringe Benefits

- GSRA Cost Estimates

- UG Monitored Costs

- Participant Support Costs

Determining staff benefits on a real cost basis

The following reports can assist you in determining or estimating benefit costs in the proposal.

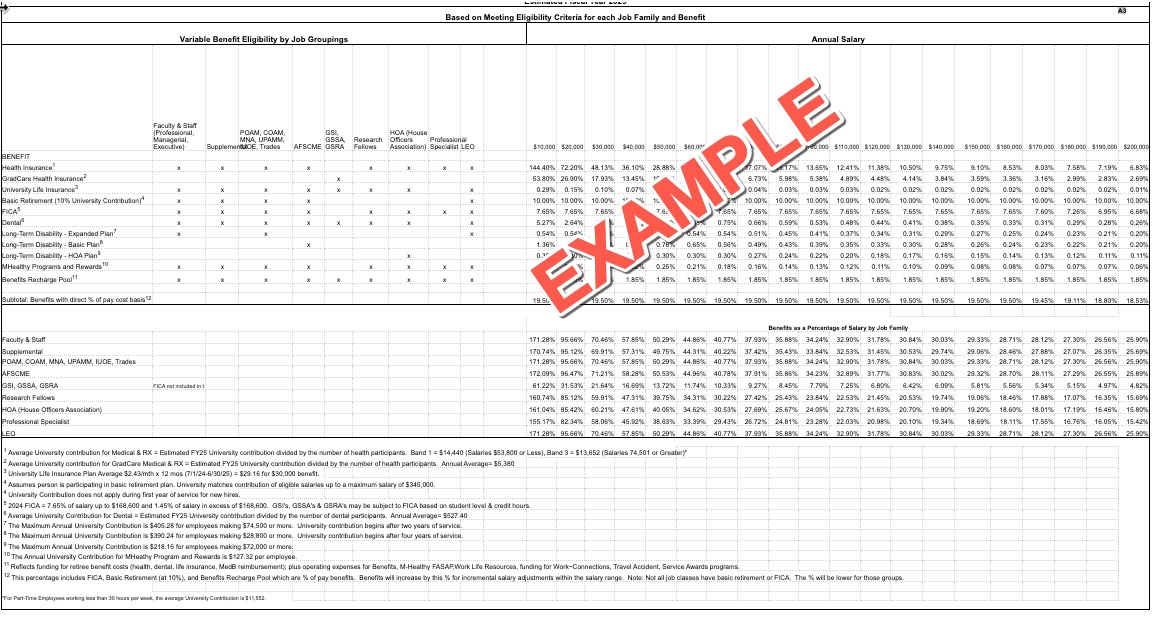

- The first resource presents the benefits as a percentage of a salary and is based on the fiscal year. It is typically renewed in July each year.

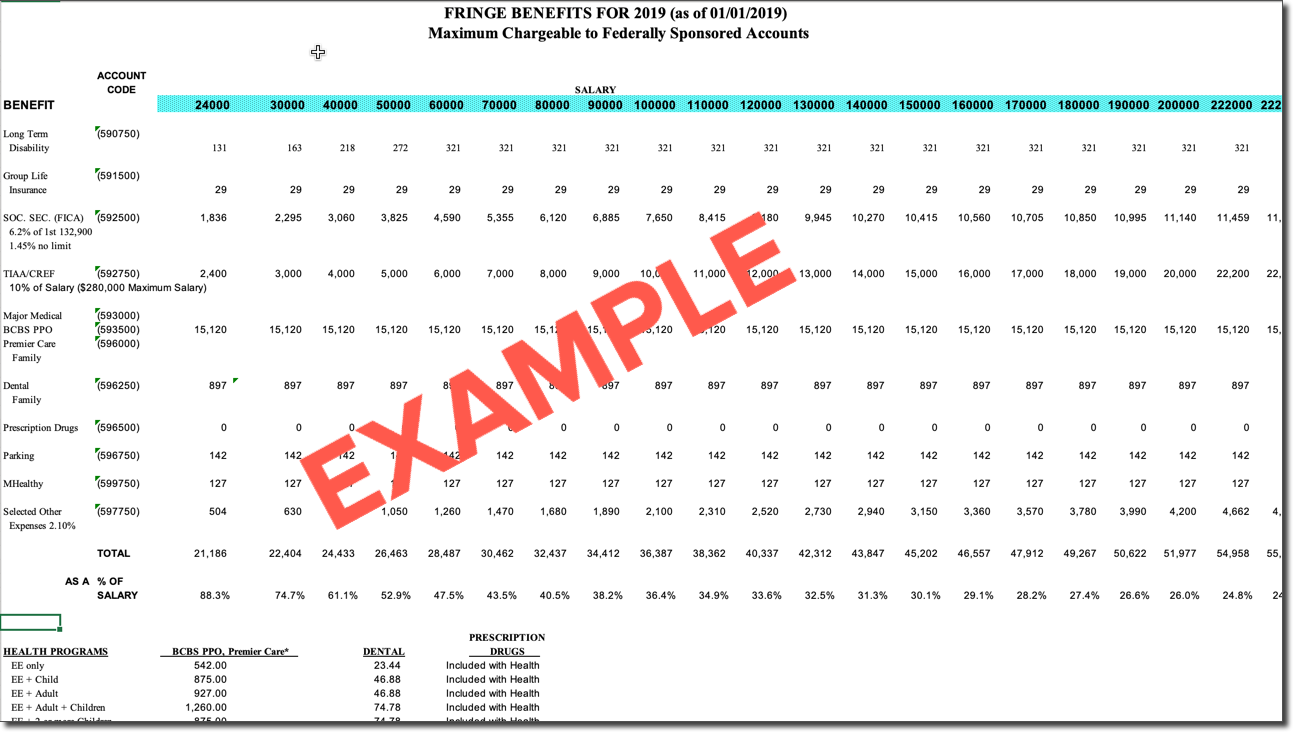

- The second resource presents the maximum chargeable to a federally sponsored project and is based on the calendar year. It is typically renewed around March each year.

Questions about these resources can be directed to the HR Benefits office.

Fringe Benefits as a Percentage of Salary

The University Costs for Benefits as a Percentage of Salary spreadsheet (sometimes called the "Final Fringe Report" will help view the costs of benefits based on a range of salaries. It displays the benefits as percentages, and it is updated each year in June/July. View historical Final Fringe reports below.

- Benefits as a Percentage of Salary Report for Fiscal Year 2025 (DropBox)

(Last shared by U-M Benefits - June 2024)

Fringe Benefits - Maximum Chargeable to Federally Sponsored Projects

This Staff Fringe Benefits Table for the Current Calendar Year will help you determine appropriate staff benefits to be included in sponsored proposals. For various salary categories, this spreadsheet presents the maximum levels of staff benefits chargeable to sponsored accounts. It displays these levels as flat costs and is updated each January.

This is not available until the first of the calendar year.

- Maximum Fringe Benefits Report as of 2024 (Excel)

(Last updated by U-M Benefits - January 2024)

Determining costs using benefit estimators

In the proposal stage, it may not be possible to determine the actual configuration of staff benefits for a particular research project. Therefore, an estimator often is used based on an average percentage of salaries committed to the project. However, if the mix of salaries for faculty and staff is distributed over a broad range (e.g., from $25,000 to $180,000), it may be appropriate to use several estimators to ensure adequate funds for staff benefits are provided in the proposal budget.

Benefits percentages vary widely--from 25% for salaries of $180,000 to almost 81% for salaries of $24,000. One estimator often used in the past, 30%, had been the midpoint in previous ranges. Units are encouraged to examine recent benefit expenditures to determine if a different estimator or several estimators should be used.

Also, see Graduate Student Research Assistants Salary and Benefit Costs

See GSRA Cost Estimates for more information.

References and Resources

- Last 10 years of Benefits as a Percentage of Salary Reports (DropBox)

-

2023 Fringe Benefits as a Percentage of Salary - Final Fringe

UNIVERSITY COSTS FOR BENEFITS AS A PERCENTAGE OF SALARY

- 2022 Fringe Benefit Report - Maximum Chargeable

- 2021 Fringe Benefit Report - Maximum Chargeable

- 2020 Fringe Benefit Report - Maximum Chargeable

- 2019 Fringe Benefit Report - Maximum Chargeable

- 2018 Fringe Benefit Report - Maximum Chargeable

- 2017 Fringe Benefit Report - Maximum Chargeable

- 2016 Fringe Benefit Report - Maximum Chargeable

- 2015 Fringe Benefit Report - Maximum Chargeable

- 2014 Fringe Benefit Report - Maximum Chargeable

- 2013 Fringe Benefit Report - Maximum Chargeable

- 2012 Fringe Benefit Report - Maximum Chargeable

- 2011 Fringe Benefit Report - Maximum Chargeable

- 2010 Fringe Benefit Report - Maximum Chargeable

- 2009 Fringe Benefit Report - Maximum Chargeable